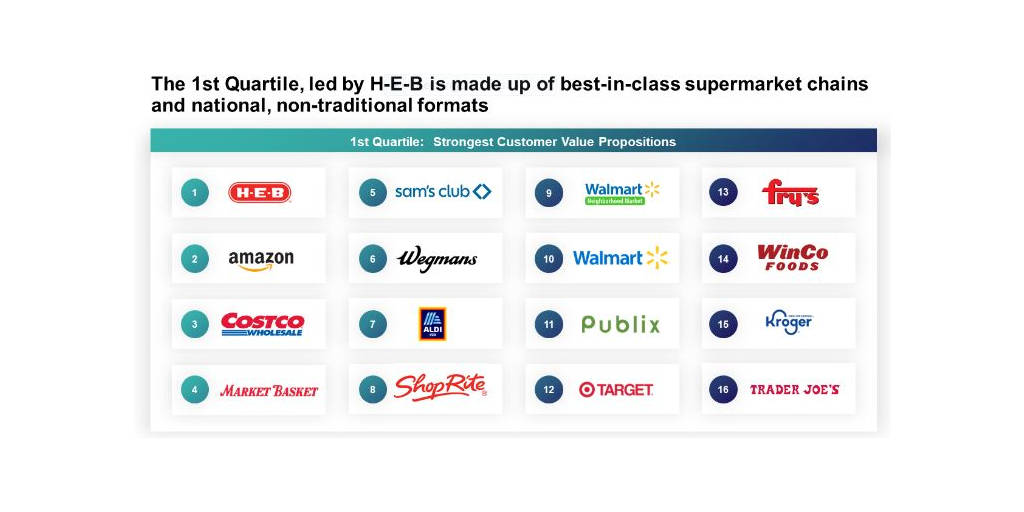

H-E-B was named the top U.S. grocery retailer in the seventh annual Retailer Preference Index by data science firm Dunnhumby. H-E-B is the first grocer to be recognized three times as number one in the RPI ranking, surpassing Amazon and Trader Joe’s who both ranked as top grocer twice.

The research includes the largest 65 retailers in the industry that sell everyday food and non-food household items. The financial data used in the Dunnhumby model comes from Edge Ascential, and the customer perception data is sourced from Dunnhumby’s annual survey of more than 10,000 American grocery shoppers.

The five drivers of the customer value proposition are: price, promotions, and rewards; quality; digital; operations; and speed and convenience.

According to the research, H-E-B topped the RPI ranking because they have the strongest customer value proposition for the long term. This is due to their ability to deliver a combination of better savings and better experience/assortment, supported by time savings through its digital capabilities, noted the research firm.

Other retailers in the top 10 (in descending order) are:

• Amazon

• Costco

• Market Basket

• Sam’s Club

• Wegman’s

• Aldi

• ShopRite

• Walmart Neighborhood Market

• Walmart

“Knowing your customer and your competitive positioning regarding customer needs will be critical for retailers to scratch out any organic growth in 2024. Customers are re-evaluating their opinions of retailers more than ever and that will only intensify in the coming months due to the economic headwinds facing consumers,” said Matt O’Grady, dunnhumby's president of the Americas, in a statement. "In this year’s RPI, we illuminate how the consumer views the grocery market, and how different retailers are meeting the general population’s needs as well as the needs of different consumer segments.”

The report also found that the U.S. grocery market sales growth will be 0.5 percent to 1.5 percent in 2024, the slowest growth rate since the Great Recession. The research firm attributes this slowdown to the economic headwinds still facing consumers, including slowing disposable income growth, lower savings rate, higher debt, cost to service consumer debt, and the drying up of pandemic-related savings buffers.

Savings through low base prices and highly personalized promotions and rewards remain the strongest driver of better long-term retailer performance, followed by maintaining a high-quality assortment, said Dunnhumby. Market Basket, Winco, and Aldi top the RPI’s “price, promotions, rewards” pillar, due to the strongest combination of mass and personalized pricing levers. Wegman’s, Trader Joe's, and The Fresh Market top the “quality” pillar.

Two Kroger banners (Kroger and Fry’s) made it to the top quartile for the first time. The banners’ move can be explained by improvements they drove in overall price perception in 2023, a year when saving customers money mattered more than any year in this study, said Dunnhumby.

Related: Walmart Expands Drone Delivery, Unveils Tech Innovations; Aldi Reaches Sustainability Milestones