Burnout from pandemic-driven, at-home meal preparation—not to mention a desire for comfort—has sent consumers toward frozen options like pizza, entrees, snacks, and ice cream, according to data from the SFA’s State of the Specialty Food Industry research, 2020-2021 Edition.

Frozen categories account for nearly 10 percent of retail market sales, shows the research, produced in cooperation with Mintel. Both frozen entrees and frozen desserts were top 10 specialty categories in retail sales, but growth had slowed pre-pandemic, from 2017-2019. COVID’s first wave created a surge.

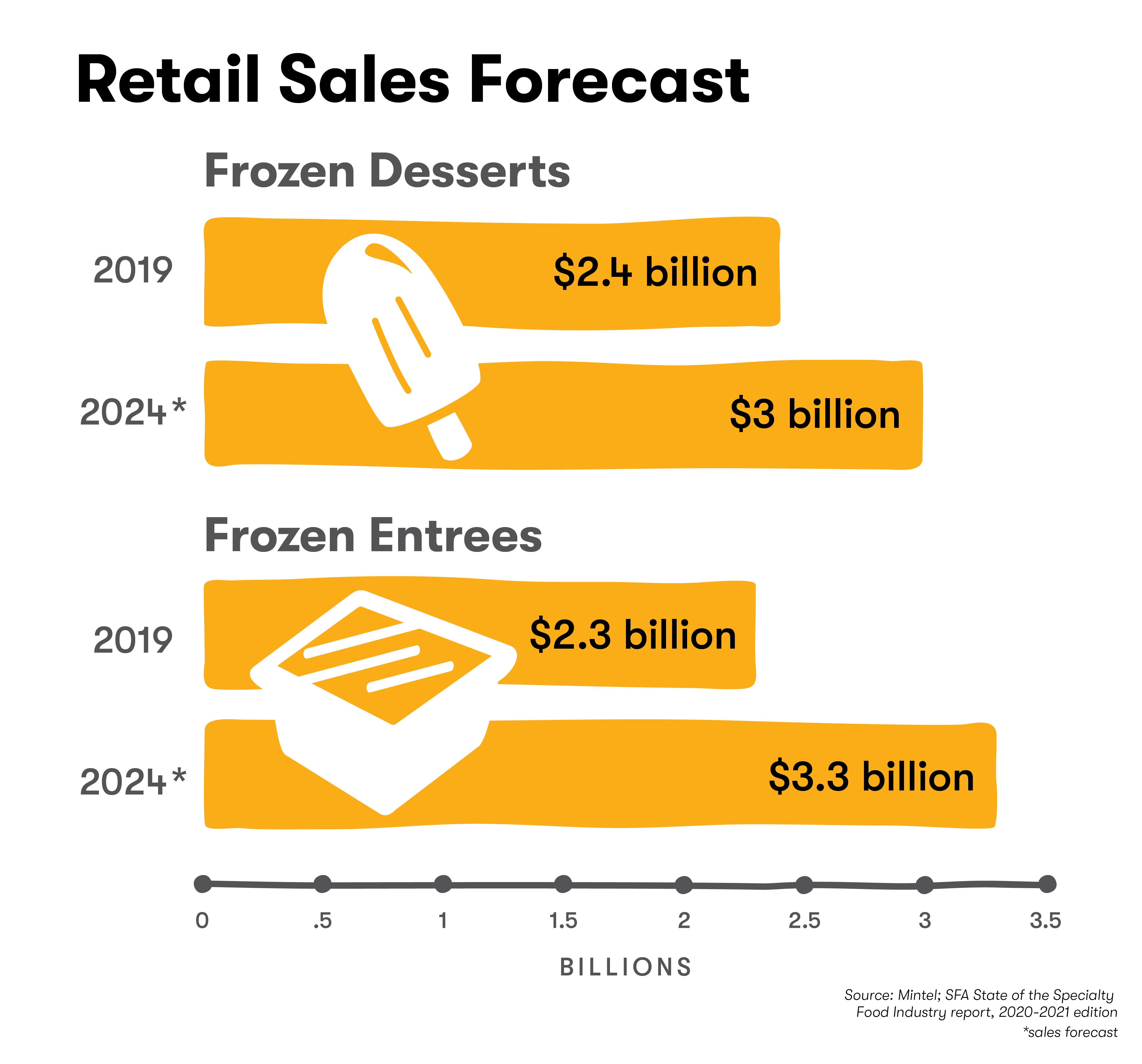

During the full first quarter of 2020, specialty frozen entrees—a $2.3 billion category in 2019—grew 20.8 percent from January-April versus sales a year prior, more than the overall frozen entree category. In March 2020 alone, specialty frozen entrees grew 54.6 percent, with items like burritos and pockets up significantly.

Increased sales continued through more COVID surges, and Mintel forecasts 7.1 percent growth from 2020-2024, higher than in the previous five years when the category grew 5.9 percent. While the frozen entree category is challenged by competition from well-funded global CPG-owned brands, plant-based meat alternatives, bowl meals, and grain-free options are among trends Mintel expects to contribute to growth.

Plant-based, non-dairy, keto-friendly varieties as well as global flavor profiles like cardamom and chai are sales drivers in the $2.4 billion specialty frozen desserts category, though it will grow slower than other frozen categories like entrees. COVID-related disruption to foodservice and the dairy market has had an impact on sales. Though specialty frozen desserts increased a healthy 14.6 percent from January to April 2020 versus a year prior, growth was slower than the 15.8 percent growth of all products in the category. Mintel projects frozen desserts will grow 4.9 percent by 2024.

Though a smaller category at $285 million, frozen breakfast foods grew 30.5 percent between 2017 and 2019, the largest jump for a frozen category. Frozen appetizers and snacks, a $524 million category, grew 10 percent in the same time period.

On-Trend Product Innovations

Plant-based. Frozen plant-based foods are a strong segment, growing 23 percent between 2017 and 2019 and encompassing 16 percent of the specialty plant-based category. New products over the past year centered on providing plant-forward options for at-home dining. Califlour Foods introduced lasagna with meat sauce, made with layers of cauliflower noodles, as well as new flavors of riced cauliflower like sesame citrus and Baja style. The Soul Solution launched plant-based, gluten- and soy-free vegan sausage in varieties like chorizo, Italian and Americano breakfast.

At-home cooking. Daily meal prep often gave way to convenience as consumers navigated the pandemic. New products to hit the market in recent months include Den’s Hot Dogs frozen meals such as Chicken & Dumplings, BBQ Chicken & Cheddar Mash Meal; and Ravioli Alfredo and Chicago Importing Co. Lars Own Swedish Meatballs.

Global, functional Sub trends. Several sub trends have emerged from the macro trend of the past year—eating and cooking at home. Consumers are seeking to replicate at home the travel and restaurants experiences they were accustomed to, according the SFA’s Trendspotter Panel’s 2021 trend predictions. The latest frozen entree launches from Saffron Road tap into global flavors like Thai Basil Noodles with Beef and Thai Red Curry Chicken with Jasmine Rice. MIC Foods released tostones, frozen fried green plantains, yuca fries, and boniato, a cousin to the sweet potato. On the frozen dessert side, Amafruits launched a line of sorbets featuring superfruits like dragon fruit, capuacu, and acerola.

Related: Frozen Meal Delivery Concept Gains Traction; Frozen Food Sales Increased in 2020.